Understanding Exness Leverage: A Comprehensive Guide

When diving into the world of online trading, one of the key terms that many traders encounter is leverage. For those who are trading with exness leverage Exness Botswana, understanding leverage can be a crucial factor in maximizing profits while managing risks effectively. This article aims to clarify what leverage is, how it works at Exness, and the implications it has for both new and experienced traders.

What is Leverage?

Leverage is a financial concept that allows traders to control larger positions than they would be able to with their own capital alone. In essence, it magnifies both potential profits and potential losses. Traders can use it to enhance their trading capabilities by using borrowed funds from their broker. At Exness, traders can benefit from various leverage ratios, providing them with flexibility to tailor their trading strategies according to their risk tolerance.

How Exness Leverage Works

At Exness, the leverage offered can vary based on the type of account and the specific financial instruments being traded. Common leverage ratios at Exness include options like 1:1000, allowing traders to control a position worth $1,000 with just $1 of their own capital. This means that even small movements in the market can lead to substantial gains (or losses), underscoring the importance of risk management.

The Benefits of Using Leverage

There are several advantages to using leverage in your trading strategy:

- Increased Buying Power: Leverage allows traders to enter larger positions without needing to commit substantial amounts of capital. This can amplify potential returns.

- Diversification: With higher capital availability, traders can diversify their portfolios by trading multiple instruments simultaneously.

- Access to Various Markets: Leverage enables traders to access markets that may have high entry costs, such as forex pairs or commodities.

The Risks of Using Leverage

While leverage has its benefits, it also poses significant risks that traders need to consider:

- Increased Loss Potential: Just as profits can be amplified, losses can also mount quickly. Traders using high leverage must be aware of this and implement strict risk management strategies.

- Margin Calls: If the equity in a trader’s account falls below the required level, brokers like Exness may issue a margin call, requiring additional funds to be deposited or positions to be closed out to prevent further losses.

- Psychological Stress: Trading with leverage can heighten emotional responses, leading to rushed decisions. This can be detrimental to trading success.

Choosing the Right Leverage at Exness

Exness offers flexible leverage settings to cater to different trading styles. Here are some tips on how to choose the right leverage:

- Assess Your Risk Tolerance: Traders need to evaluate how much risk they are willing to take. Higher leverage means higher risk, so it’s important to choose a ratio that aligns with your risk appetite.

- Consider Your Trading Strategy: Day traders might prefer higher leverage to capitalize on short-term price movements, while long-term traders may opt for lower leverage to reduce risk exposure.

- Stay Informed: Keep up with market trends and news, as these can impact the volatility of the instruments being traded and thus affect the level of acceptable leverage.

Managing Risk When Using Leverage

Effectively managing risk is essential when trading with leverage. Here are some strategies that traders can employ:

- Use Stop-Loss Orders: Implementing stop-loss orders helps automatically close trades at predefined levels, limiting potential losses in volatile markets.

- Regularly Monitor Positions: Active monitoring enables traders to make timely decisions and adjust strategies as market conditions change.

- Educate Yourself: Continuous learning about market dynamics, trading principles, and behavioral psychology can enhance decision-making and risk management skills.

The Role of Exness in Your Trading Journey

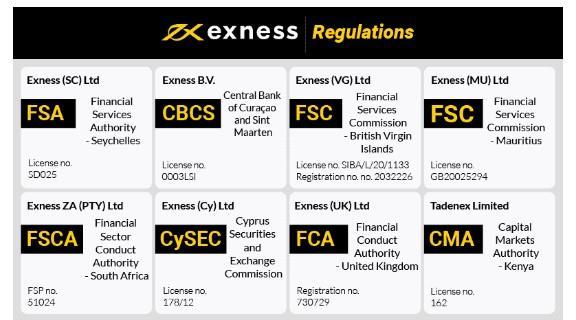

Exness provides a comprehensive trading platform with tools designed to help traders navigate the complexities of leverage. By offering various types of accounts, educational resources, and customer support, Exness empowers traders to make informed choices. Whether you’re a beginner or a seasoned professional, understanding Exness leverage is fundamental to optimizing your trading performance.

Conclusion

Leverage can be a powerful tool for traders looking to enhance their trading experience. However, it comes with both opportunities and risks. By understanding how Exness leverage works and implementing sound risk management practices, traders can make the most out of their trading endeavors. Always remember that successful trading is not solely about profits; it’s also about safeguarding your capital and making informed decisions.

In the ever-evolving world of financial trading, knowledge and strategy are paramount. As you embark on your trading journey with Exness, leverage your resources wisely, remain aware of potential risks, and strive to improve continuously. With these principles in mind, you can navigate the markets with confidence and aim for success.