What is Swap in Forex Trading?

In the world of forex trading, which involves the exchange of currencies, the term “swap” can often come up. A swap in forex refers to the fees that traders incur for holding positions overnight. Understanding swaps is crucial for forex traders, as they can significantly affect trading profits and losses, especially for those who engage in long-term trading strategies. In this article, we will delve into what swaps are, how they work, and how they can impact your trading experience. For more resources on trading, visit what is swap in forex trading Trading Area NG.

What Exactly is a Forex Swap?

A forex swap is an interest paid or received for keeping a currency position open overnight. Forex dealers offer swaps based on the difference in interest rates between the two currencies involved in the trade. When a trader holds a position for more than one trading day, the broker usually applies a swap rate to the trader’s account at the end of the trading day, which in the forex market is at 5 pm EST. This fee can either be positive or negative, depending on the positions held and the influence of interest rates.

How Forex Swaps Work

To understand how forex swaps work, it is essential to know how interest rates influence the swap. Each currency pair involves two interest rates. When a trader buys one currency and simultaneously sells another (e.g., going long on EUR/USD), they are effectively borrowing one currency to buy another. The interest rate differential between the two currencies determines whether the trader will earn or pay a swap fee.

If the currency being bought has a higher interest rate than the one being sold, the trader may earn a positive swap. Conversely, if the interest rate on the owned currency is lower, the trader will incur a negative swap. The swap rates can vary from broker to broker, and they can change daily according to market conditions and central bank interest rates.

Types of Forex Swaps

There are generally two types of swaps in forex trading:

- Positive Swap: This occurs when the trader earns interest on the position held overnight. This typically happens when the currency being bought has a higher interest rate compared to the one being sold.

- Negative Swap: A negative swap occurs when the trader has to pay interest on the position held overnight. This happens when the currency bought has a lower interest rate compared to the currency sold.

Importance of Swaps in Forex Trading

Understanding swaps is significant for several reasons:

- Impact on Profitability: Swaps can significantly affect overall profitability, especially for long-term positions. Traders need to account for these costs when calculating potential returns.

- Informed Trading Decisions: Being aware of swap rates allows traders to make more informed decisions regarding which positions to hold overnight.

- Strategy Development: Traders often develop strategies that take advantage of positive swap rates, leading to a form of carry trading where traders deliberately hold positions in currencies with higher interest rates.

Calculating Forex Swaps

Calculating forex swaps can be a bit complex since it largely depends on the broker’s policies and market conditions. Most brokers have a specific formula for determining the swap rate, but a basic understanding of the factors involved can help traders estimate their potential swaps.

The typical formula involves the following elements:

- Notional amount of the trade

- Interest rate differential

- Length of the period (1 day in forex)

- Currency conversion if applicable

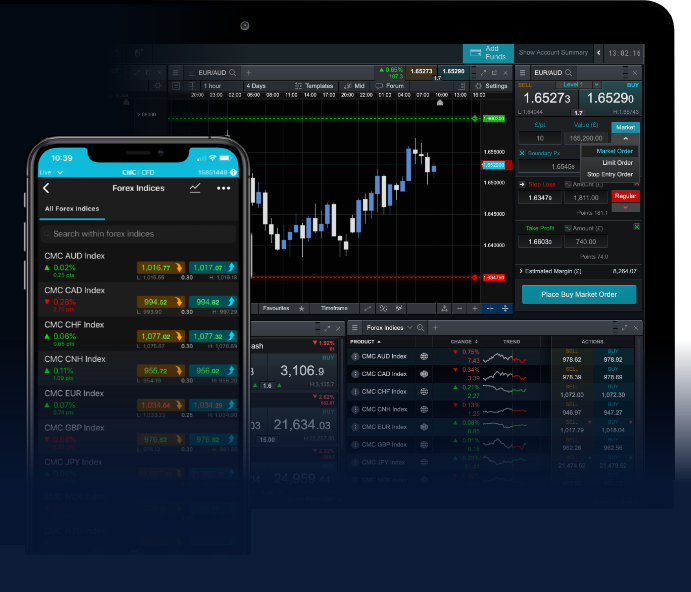

Traders can access swap rates directly on their trading platforms. Many platforms display this information as part of the position details, allowing traders to see potential costs or earnings before executing a trade.

How to Manage Swaps Effectively

Managing swaps efficiently can help traders maximize their profitability. Here are some tips:

- Choose the Right Broker: Different brokers have different swap rates. Researching and comparing swap rates from various brokers can help you choose one with favorable conditions.

- Select Currency Pairs Wisely: Traders should consider the interest rate differentials when choosing currency pairs. Opting for pairs with high differential rates can result in potential rewards.

- Utilize Swap-Free Accounts: Some brokers offer swap-free accounts, also known as Islamic accounts, which do not impose interest fees. This option could be beneficial for traders who wish to avoid swap fees.

Conclusion

In summary, understanding what a swap is in forex trading is fundamental to making informed trading decisions. It is an integral part of managing your forex trading strategy, especially for those who plan to hold positions overnight. By being aware of how swaps work, how they are calculated, and their impact on trading outcomes, traders can better navigate the complexities of the forex market and optimize their profits while minimizing potential costs. Whether you are a beginner or an experienced trader, integrating swaps into your trading strategy can provide significant advantages in achieving your trading goals.